Beautiful Tips About How To Avoid Garnishment

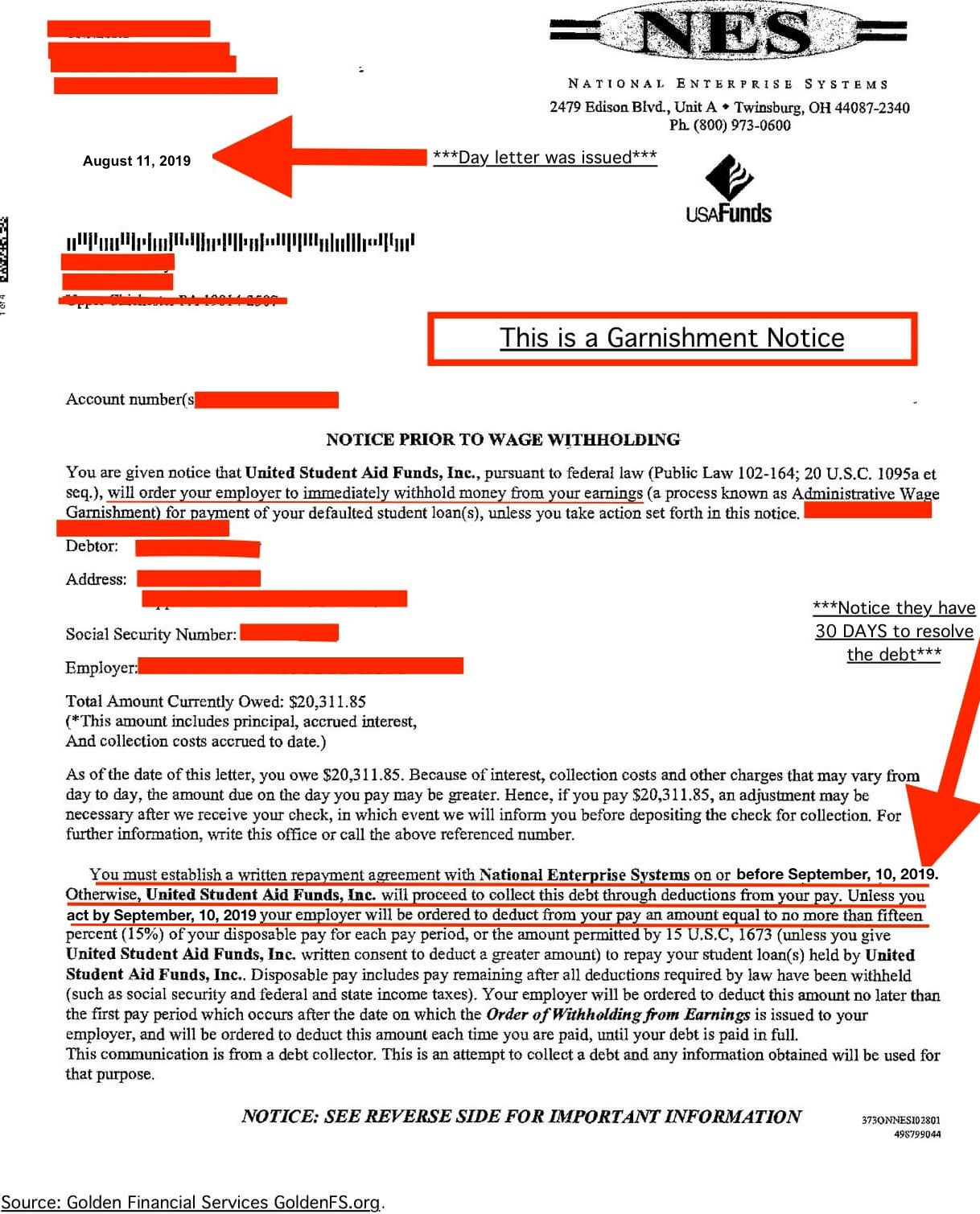

Prior to an individual’s case going to court, they can try to negotiate with the creditor for a payment plan.

How to avoid garnishment. Respond to the creditor's demand letter. If you work out a payment plan with the court you can avoid the creditor using garnishment to collect on the debt. If the individual and the creditor can agree to a plan, the creditor can put a.

When you file chapter 7 or chapter 13 bankruptcy, an “automatic stay” comes into place. Once a creditor has obtained a judgment against you, many states require that. In most bankruptcy cases, an injunction called an automatic stay goes into effect when a.

X research source [84] x research source Here are a few tips to know about stopping wage garnishment: You may be able to escape the garnishment order permanently by filing for bankruptcy.

Be aware that if you do this and then do not make the. How does bankruptcy stop garnishment. The automatic stay is a federal injunction.

In some situations, you can prevent a wage garnishment without bankruptcy. Sole proprietors may be at risk of garnishment due to personal debts. After court notice has been given, you may have only between five and 30 business days to contest the complaint before any financial seizure begins.

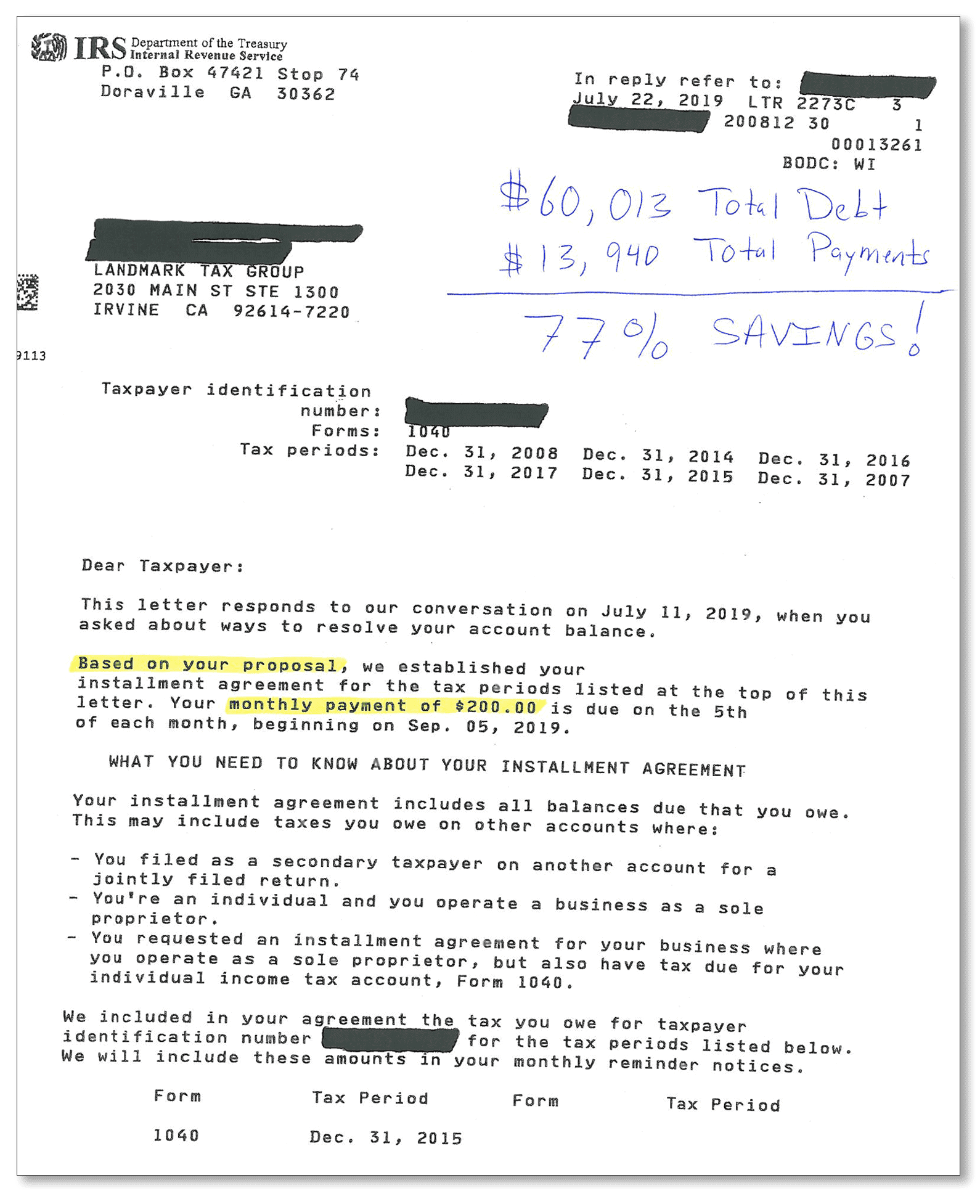

The easiest way to avoid irs wage garnishment is to pay off your debt. Satisfy the debt in full or file bankruptcy. It is possible to file legal motions or find other ways to make a deal with debt collectors with a repayment plan.