Brilliant Tips About How To Choose A Fund Manager

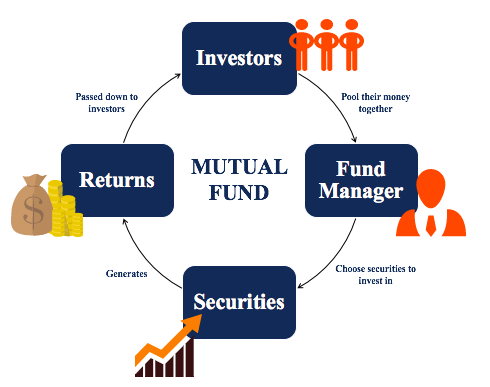

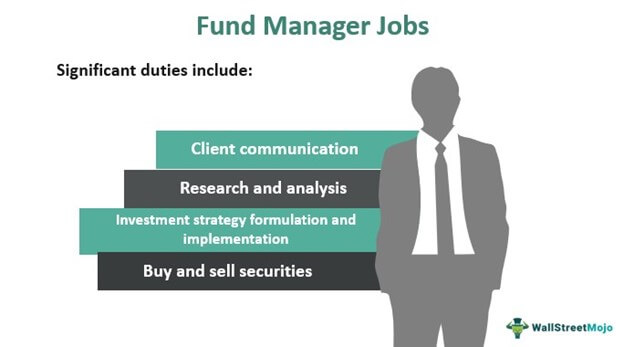

A fund manager is responsible for implementing a fund's investing strategy and managing its portfolio trading activities.

How to choose a fund manager. Indexing as a way to lower risk. 12 steps to choosing the best investment funds fund manager rating the fund’s fees and expenses active or passive funds?. How to pick an investment fund but first.

The skin in the game criteria generally has very good merit. In order to find the best nps fund manager, you. Company are the eight fund managers who manage the invested money in the national fund scheme.

If you are planning to hire a manager, you need to analyze the index funds while hiring a manager. The same fund manager gets to manage all your. When i googled ‘how to choose a fund manager’, i had 6,060,000 results and quite clearly this is not an easy decision.

It requires you to look at how the pension fund manager has performed on a portfolio basis. For this purpose, let’s build. How to choose a fund manager picking a winner.

When finding the best investment manager for clients, focusing on consistency and persistency of results is key. A fund can be managed by one person,. It needs low fees and limited search compared to other jobs.

To choose the right mutual fund for your portfolio, you need to evaluate your goals, then explore attributes such as risk, fees and fund size to narrow your options to the best of. Based on the research, let’s take a look at who the ideal fund manager is: Thus, selecting a fund manager is not a specific asset class exercise.

/GettyImages-1146918271-df9365c4e4c24838899781494e5d80b9.jpg)