Outstanding Tips About How To Improve Average Collection Period

If you spread the word that a customer is a bad risk, you risk a defamation lawsuit.

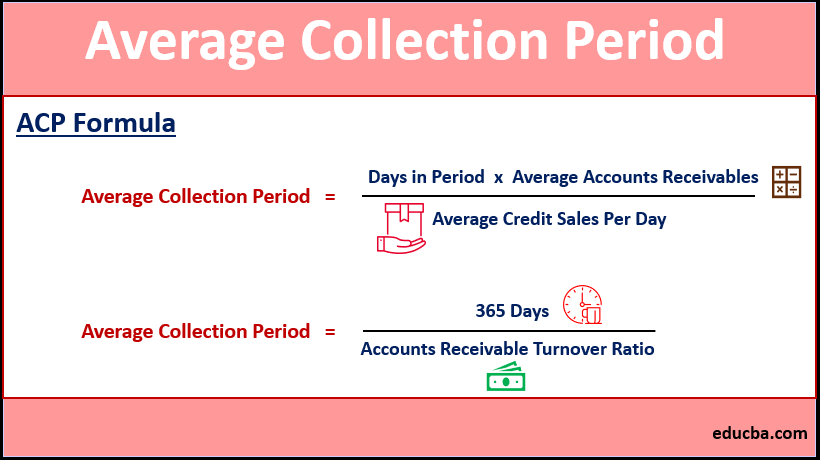

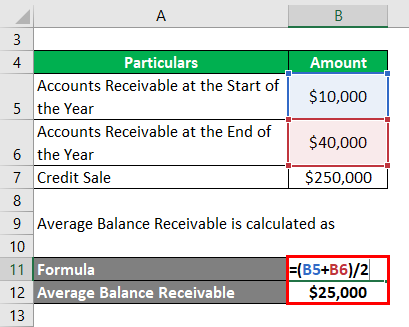

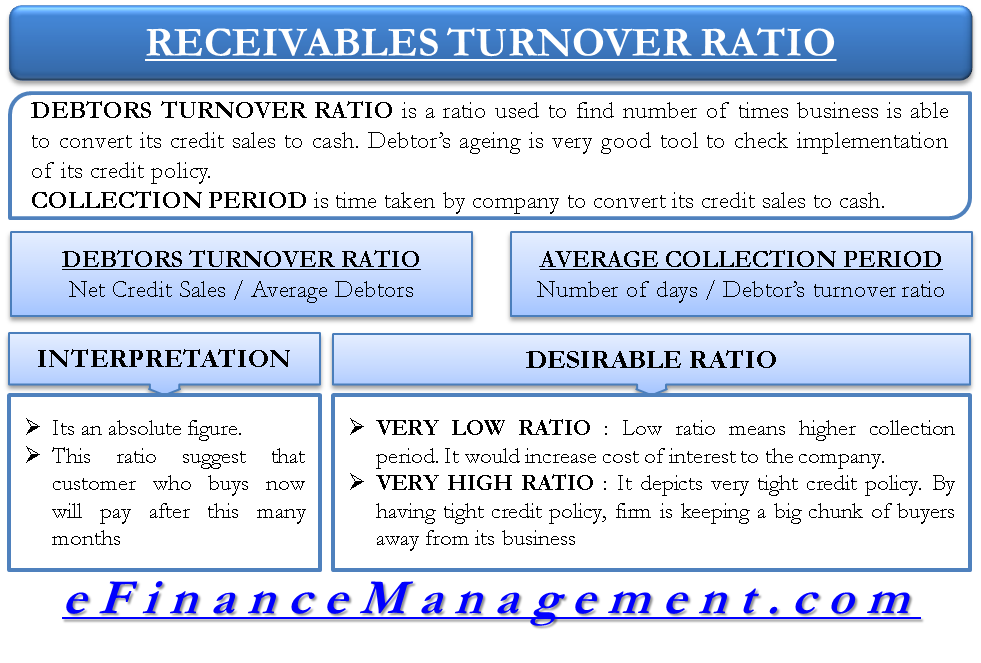

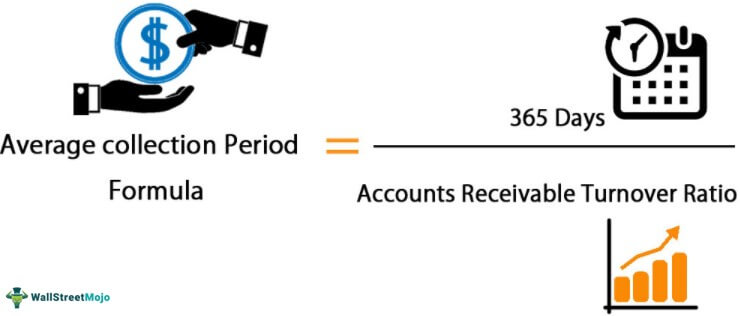

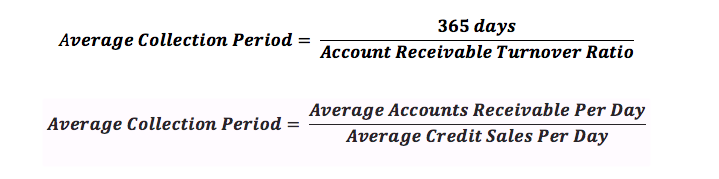

How to improve average collection period. Or, collection period= 365 / 6 = 61 days (approx.) big company can. The formula for the average collection period is: What does an increased average collection period mean?

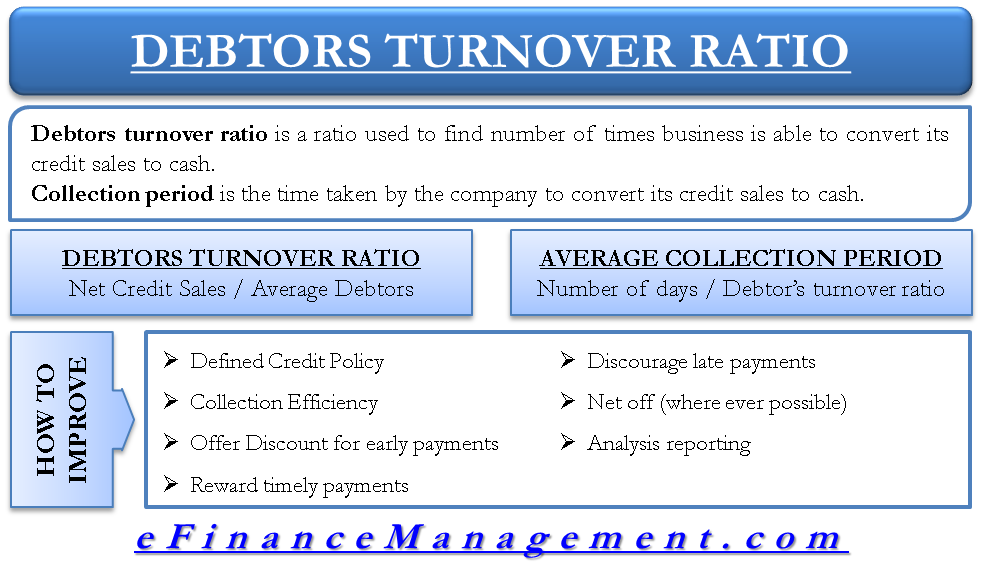

You can improve your average collection period by reducing the time it takes customers to make payments. If you know the accounts receivable turnover ratio for the business, you can use the following, simplified calculation. Build strong client relationships the first rule of thumb with accounts receivable is to establish strong client.

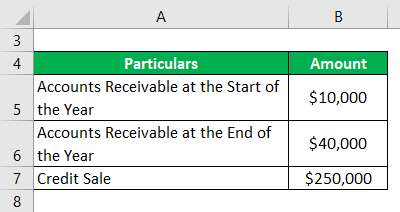

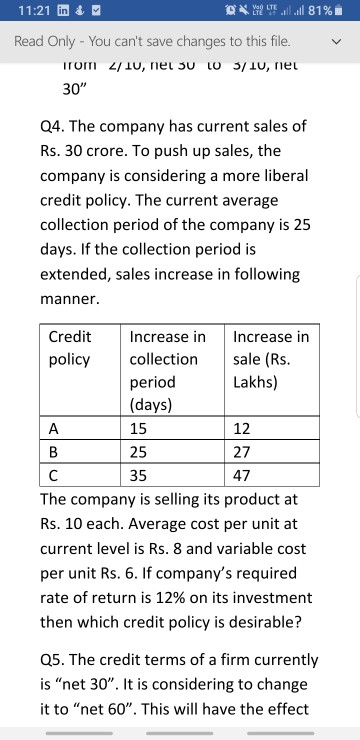

One way is to offer discounts to customers who pay their invoices within a certain number of days. Now, we can do the average collection period calculation. The measure is best examined on a.

Electronic invoicing eliminates the obvious delays and costs associated with postal mail, but the benefits of leveraging electronic invoicing are so much greater than. How to calculate your average collection period. An increase in the average collection period could be a sign of any of the problems listed below.

It comes down to leveraging tools that streamline collections from. Management may decrease the length of credit or tweak its credit policy so to reduce credit. There are a number of ways that businesses can improve their average collection period.

You first need to know your average accounts receivable for the period you’re calculating. Act in a businesslike fashion. Here are a few things you can do to promote timely payments.

:max_bytes(150000):strip_icc():gifv()/AverageCollectionPeriod_Final_4201163-b8c6c4e366854998922cf19de6da84b8.png)